Texas Budget 101: Ultimate Word Bank of Financial Terms Your Board Should Know

A Simpler Approach to Budget Season

So why wait? Request a proposal and let our team help simplify your budget season today. Just fill out the form below, and we’ll be in touch shortly.

As a member of your association’s board, you've got a big responsibility on your hands. Especially during Texas budget season, your homeowner peers are counting on you to stay up-to-date on financial reports, make the right calls that will enhance their property values, and ultimately make decisions that will determine the success of the entire community. No big deal, right?

Okay, maybe it is a big deal. In fact, studies have shown that Texas communities with well-informed boards tend to have healthier financials and higher property values. Memorizing financial terms may seem tedious at first, but if you can comfortably talk about things like deferred maintenance, reserve fund, and special assessment (just to name a few), you’ll be better equipped to make more informed decisions and communicate more effectively about your COA or HOA financials.

In other words, knowing your financial terms isn't just important—it's essential. But let's be real, who has the time to sift through all those lengthy definitions? That’s why we've done the heavy lifting and put together a concise list of financial terms commonly used among Texas associations. Whether you're a newbie or just need a refresher, this resource is here to help you elevate your game.

Remember: A little financial literacy can go a long way in building trust between you, your fellow board members, and residents.

Glossary: Terms your board should know before budget season.

Accounts payable: Money that the association owes to vendors and contractors.

Accounts receivable: Money owed to the association.

Administrative costs: Costs incurred to support the functioning of a business, but which are not directly related to the production of a specific product or service.

Annual meeting: A meeting that takes place once a year to inform homeowners what projects are complete, what to expect for the year, and present the new annual budget.

Assessments: Mandatory fees that owners/members must pay on a monthly or annual basis and can differ based on the type of project and/or operating costs that need to be covered in the development.

-

Special assessment: A one-time fee each homeowner pays the association to cover costs for a major project, unplanned maintenance or repairs, or an emergency.

Assets: Resources owned by the association that has economic value (e.g., bank account money).

Bad debt: Fees owed to the association that you don’t expect to collect.

Balance sheet: A statement that shows a snapshot of the financial situation of the association.

Bank reconciliation: A process for comparing bank statements against the association’s financial records and determining the cause of discrepancies (e.g., uncashed checks).

Budget: The financial plan for an HOA which estimates income, expenses, and reserves for a certain period of time.

Bylaws: Include the conduct, elections, and responsibilities of members of the board as well as provisions on the board of directors, internal governance, and the association's operation.

Capital improvements: The addition or alteration to real property that:

-

Substantially adds to the value or prolongs the useful life of real property.

-

Becomes part of or permanently affixed to the real property so that removal would cause material damage to the property or article itself.

-

It is intended to become a permanent installation.

Deferred maintenance: Repairs that get postponed and marked as a lower priority status in order to save costs, meet budget funding levels, or realign available budgets.

Deficit: The amount by which spending exceeds income.

Delinquency rate: The percentage of homes that are behind on association fees.

Equity: The difference between the association’s assets and liabilities.

Fiduciary: The ethical and moral obligation of the Board to make decisions for the benefit of everyone in the community in a fair and prompt manner.

General ledger: A complete and ongoing record of all financial transactions that your association has made over a designated period (month, year, lifetime).

Governing documents: A collection of documents that include the declarations, bylaws, operation rules, articles of incorporation, and other materials which regulate the association’s day-to-day operations.

Liabilities: The association’s financial obligations or debts.

Operating costs: The cost for the day-to-day operation of the association (e.g., maintenance, utilities, landscaping, and professional services).

Reserve fund: A property savings account funded by a percentage of your association’s monthly fees that serves as a cushion to protect the building’s finances from the burden of necessary future expenditures.

Reserve study: Helps with long-term financial planning by assessing the current reserve fund and determining how much funding will offset ongoing wear and tear and future community enhancements. The reserve study consists of a comprehensive analysis of the community’s assets and a detailed financial analysis.

Revenues: Generated income before deducting expenses.

Statement of Income & Expense: A summary of the income and expenses in each month, the amount budgeted, the difference between the two, and year-to-date amounts.

Variance: The difference between expected and actual expenditures.

Working capital: The amount of money the association needs to have on hand to cover differences in cash flow.

For a printable glossary-on-the-go, click here: Glossary-Budget-Basics-101-1.pdf

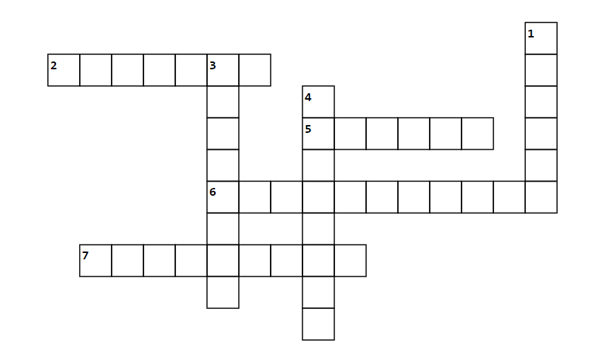

Budget Basics Crossword Puzzle

Time to put your skills to the test! Using the glossary above as your word bank, see how many terms you remember using the puzzle below. Play the interactive version here: Budget Basics 101 Crossword Puzzle.

Across

2. Fund; A property savings account funded by a percentage of your association’s monthly fees that serves as a cushion to protect the building’s finances from the burden of necessary future expenditures.

5. The difference between the association’s assets and liabilities.

6. Mandatory fees that owners/members must pay on a monthly or annual basis and can differ based on the type of project and/or operating costs that need to be covered in the development.

7. The ethical and moral obligation of the Board to make decisions for the benefit of everyone in the community in a fair and prompt manner.

Down

3. The difference between expected and actual expenditures.

4. Type of maintenance repairs that get postponed and marked as a lower priority status in order to save costs, meet budget funding levels, or realign available budgets.

Property management is a balancing act.

When you lead your community on a path to change, every decision is an important one. With competing priorities, juggling it all as a community leader can seem complex. But here’s the good news: it doesn’t have to be. No matter the property type, our local team has the expertise and solutions to anticipate your needs and respond. Our service-first philosophy means we don’t stop until what’s complicated becomes uncomplicated.

Welcome to life, simplified.

If you’d like to learn more about how you can simplify budget season for your association, reach out today at [email protected]. We’ll be in touch soon.

How Can We Simplify Your Budget Season?

This budget season shouldn’t feel like a headache for your Texas board. Our expert team is here to provide you with all the services and solutions you need to take your community to the next level. Whether you're needing help with managing your association’s finances or looking to finally streamline your day-to-day operations, we've got the experience and resources to make it happen.We’d love to learn more about how we can support your association. Fill out our form to request a proposal and let our team help simplify your budget season today.